What does the social media landscape look like in China?

28 Apr, 14 | by BMJ

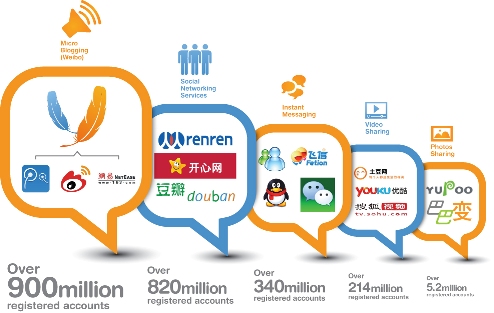

Contrary to popular belief, limited access to certain Western websites has done little to harm the development of social media in China. In fact, it is reported that 91% of Chinese internet users have a social media account, compared to 67 per cent in the US. Given that China has become the world’s second largest economy, how can businesses use social media channels to reach its huge consumer base?  China has around 591 million internet users and a strong leaning towards mobile (desktop traffic dropped by 15% in the first nine months of 2013). On average, users spend 46 minutes per day on social sites, follow eight different brands and place great importance on recommendations from other users when purchasing products. However, the Chinese government exerts significant control over social networks, blocking global heavyweights like Facebook and Twitter, and censoring home-grown networks. The Government insist on a real name policy, and allow censors to delete posts as they see fit. A law has also been passed stating that those who post ‘inaccurate’ statements that have more than 500 shares could be incarcerated.

China has around 591 million internet users and a strong leaning towards mobile (desktop traffic dropped by 15% in the first nine months of 2013). On average, users spend 46 minutes per day on social sites, follow eight different brands and place great importance on recommendations from other users when purchasing products. However, the Chinese government exerts significant control over social networks, blocking global heavyweights like Facebook and Twitter, and censoring home-grown networks. The Government insist on a real name policy, and allow censors to delete posts as they see fit. A law has also been passed stating that those who post ‘inaccurate’ statements that have more than 500 shares could be incarcerated.

Twitter and its local competitors

Twitter is one of the social networks that is blocked in China but it still has around 50,000 users who access the site via VPNs. Despite this, microblogs, or ‘weibos’, remain a very popular communication channel:

Sina Weibo

Sina Weibo is the most popular social network in China, with around 600 million registered users; half of which are active. Its approach to multimedia content – displaying video and photos within user timelines -actually predated Twitter’s rollout of these services. While users were once openly outspoken on the network, increasing censorship has curbed this.

Tencent Weibo

Sina Weibo’s main competitor is Tencent Weibo; the third most popular social network in China with more than 230 million active users. It has a user base of 600 million users, thanks to Tencent’s instant messaging service, QQ, and its users are generally from smaller cities.

Facebook and its local competitors

Facebook is blocked by the ‘great firewall of China’, although again, people are still managing to access it using VPNs. Facebook has reported that its market share in China is “almost zero“, which may well have led to the range of home-grown competitors that are on offer:

RenRen

Originally known as Xiaonei (which means campus), RenRen was set up in 2005 and is largely used by students and teens. More of a Facebook-like social network, RenRen was starting to lose out to more mobile-friendly social networks, as it lacked a suitable mobile version. In late 2013, RenRen launched a new mobile app targeting a younger demographic. It has now increased its registered users to 194 million and reached 54 million monthly active users.

students and teens. More of a Facebook-like social network, RenRen was starting to lose out to more mobile-friendly social networks, as it lacked a suitable mobile version. In late 2013, RenRen launched a new mobile app targeting a younger demographic. It has now increased its registered users to 194 million and reached 54 million monthly active users.

Pengyou

Owned by Tencent, the name literally translates as ‘friend’ in Chinese. Pengyou has more than 259 million users. Similar to Facebook, users can befriend people and follow brands. The site has less active users than RenRen and the Weibos (microblogs), but as part of the Tencent QQ network (which has more than 784 million active accounts) it has a much bigger user base.

Kaixin 001

Kaixin is a Facebook-like social network with 113 million users. Unlike RenRen, Kaixin’s target audience is older and more professional.

A varied landscape

Social media in the West is largely dominated by Facebook and Twitter. Facebook set itself apart from competitors by gradually integrating external applications and positioning itself as an international advertising hub. Twitter, on the other hand, distinguished itself by focusing on current affairs (largely through the omnipresent ‘hashtag’) and its ‘trending’ feature. Both sites continue to attract users at an impressive rate and their dominance remains largely unthreatened. Although social media in China is largely dominated by Tencent in terms of users, this grip is primarily held through mobile networking. When looking at desktop-based social networking, there is a huge amount of variation. With sites such as Sino Weibo (effectively the Chinese spin on Twitter), RenRen (the Chinese Facebook, both in terms of functionality and style) and Douban (similar to MySpace and popular with niche communities) all boasting well over 100 million accounts, the social media make-up of China expands far beyond a single dominant monopoly or duopoly. Add to that the fact that Facebook and Twitter are not entirely obsolete in China due to the increasing accessibility of VPNs,the social media landscape in China is both varied and complex. However, being the most populous country in the world, it is not one that many businesses can afford to ignore.